Reversal patterns: A key for unlocking cryptocurrency markets

The world of cryptocurrencies has been known for its volatility and unpredictability. However, with the emergence of new market trends and indicators, traders and investors can better understand where markets are going. Such an indicator is the reversal models, which have been shown to be a valuable tool in predicting market movements.

What are the reversal models?

Reversal models refer to specific models of price movement that appear when the price of an asset begins to decrease or increase and then reverse the direction. These patterns can provide valuable information on the basic dynamics of a market, allowing traders to identify potential trends and predict future price movements.

Types of reversal models

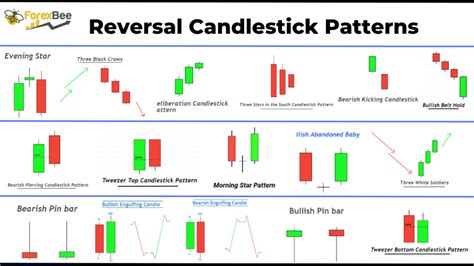

There are several types of reversal models, including:

* Head and shoulders

: A classic model involving a tip followed by a decline and then a comeback.

* Inversion of the triangle : a type of reversal model that is formed when a trend is about to change direction, often accompanied by increased volatility.

* Sephew reversals : A model that appears when the price of an asset decreases or rises in a specific way on a candlestick graph.

How to identify reversal patterns

Identifying reversal models requires a combination of technical analysis and market feeling. Here are a few steps to follow:

- Analysis of the tendency tendency tendency : Understand the general tendency of a market before identifying the potential reversal models.

- Search confirmation signals : Use indicators such as moving media, RSI or Bollinger bands to confirm potential reversal models.

- Monitoring of the market feeling : Be careful about the feeling of the market, including news and socialization discussions, to evaluate the power of the tendency.

- Use diagram models : Studies of study diagrams, such as head and shoulders, triangles and candle reversals to identify potential reversal points.

Examples of successful reversal strategies

Some successful traders and investors have used reversal models to predict market movements. Here are some examples:

* The FTX collapse : In 2022, the collapse of the Cryptocurrency FTX exchange has led to significant price decreases for many other assets.

* Dogecoin bub : The rapid growth of Doge (Dogecoin) in 2017-2018 was followed by an increased correction and later meeting.

* The Bitcoin Taurus Square : The first days of the Bitcoin Taurus market have been marked by strong price earnings, which have since slowed down.

Conclusion

Reversal models are a valuable tool for traders and investors who want to achieve a perspective on cryptocurrency markets. Understanding different types of reversal models and how to identify them, traders can better predict market movements and make more informed investment decisions. Remember, however, that no trading strategy is righteous and it is essential to always do your own risk research and management before entering any transaction.

additional resources

* Crypto trading strategies : [www.cryptotradingstrates.com] (

* Cryptocurrency market analysis

: [www.cryptomarketanalysis.com] (

* Reversal pattern indicators : [www.reversalpternindicators.com] (

Following the principles presented in this article and incorporating reversal models in your trading strategy, you can get a better understanding of cryptocurrency markets and you can make more informed investment decisions.