The importance of trend lines in cryptocurrency trading **

Cryptocurrencies have gained immense popularity in the past ten years, and many investors and dealers jumped on the train. As with any financial instrument, however, the trade cryptocurrencies are associated with their own risks and challenges. A crucial aspect that can affect the performance of a cryptocurrency are trend lines.

In this article, we will deal with the importance of trend lines in cryptocurrency trade and examine how they can be used to identify potential chances of winning, manage the risk and to make well -founded investment decisions.

What are trend lines?

Trend lines are graphic indicators with which future price movements are predicted on the financial markets. They consist of a series of connected points at which the price campaign converges or deviates. The trend line is based on these points and serves as a guide for potential price movements.

In connection with the trade in cryptocurrencies, trend lines can be applied in different types of diagrams, including candle patterns, wave counts as well as support and resistance levels.

Types of trend lines

There are different types of trend lines that can be used in cryptocurrency trading:

- Slide average (MA) trend line

: The sliding average is a simple trend line that plans the closing course over a certain period of time such as 20 or 50 days.

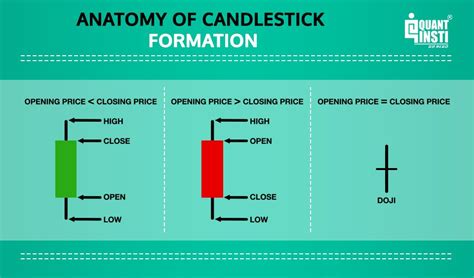

- Candlestick sample -trend line : candlestick patterns such as the hammer, the reverse hammer and the shooting windows can be used to identify potential trend reversions.

- Support and resistance (S/R) Trend line : Support and resistance levels are crucial for the determination of areas of price support and resistance.

Importance of trend lines in cryptocurrency trading

Trend lines have a certain meaning in cryptocurrency trading:

- Identifying trend reversations

: By analyzing the trend line, retailers can identify potential reversals and buy/sell signals.

- Management of risks : Trend lines help dealers manage the risk by identifying support and resistance areas where prices may jump back or fall.

- Prediction of price movements : Trend lines offer a predictive framework for price movements and help dealers to be expected to expect future price changes.

Best practice for the use of trend lines

To get the best out of trend lines in cryptocurrency trading:

- Use an average to long -term period : Use trend lines with a medium to long -term period, e.g. B. 50 to 200 days.

- Use several trend lines : Use several trend lines to confirm purchase/sales signals and identify potential support and levels of resistance.

- Combine with other indicators : Combine trend lines with other technical indicators such as RSI and Bollinger tapes in order to obtain a more comprehensive understanding of the market conditions.

Real-World Example

In order to illustrate the importance of trend lines in cryptocurrency trade, we consider an example:

Suppose we act Bitcoin (BTC) in a 4-hour diagram. We find that the moving average tends upwards, while the candlestick pattern forms a hammer on a resistance of $ 40,000.

With this information we can use several trend lines to confirm our purchase/sales signals and identify potential support and resistance levels:

- Slide average (MA) trend line: $ 35,000

- Candlestick pattern trend line (hammer): $ 30,000-33,000

- Support level (resistance): $ 35,000

By using these trend lines, we can make well -founded investment decisions and identify potential potential chances of winning.

Diploma

In summary, trend lines are a crucial aspect of cryptocurrency trade. By understanding the importance of trend lines and the effective use, retailers can obtain a more comprehensive understanding of the market conditions and make a more and more well -founded investment decisions.