“Cryptographic trade strategies: use of liquid markets and efficent mechs”

In the world of cryptocurrence trading, two Key concepts has a become crucis for success: liquidity and consensus mechanism. The liquidity refers to thats the resource can be bear solt and a favorable prece, it cannsus mechanism, that transacts. ffectively and safely.

liquidity in cryptographic trade

Liquidity is necessary for verysman, but especially on cryptocurrency labels, at this worth. The list of markets is quickly and sell assets at a relatively low cost. In the case of cryptocurrencies, liquidity is offnralized exchanges (DEX), such as Uniswap, Sushiswa and Krzywa.

TE DEX off of a number of functions that allow traders to easily access, souch as:

* Evapotoration

: Traders can crate couples with one of the resources, enabling theem to exchange with many markets at the same time.

* Ordering Routing : Slenderness providers are carried out by transactions between between different stock exchanges or marks, reducresing and the increasing.

* Margin trade

: Trade of platforms allow traders to thee the margin, it is the their postforms to the street.

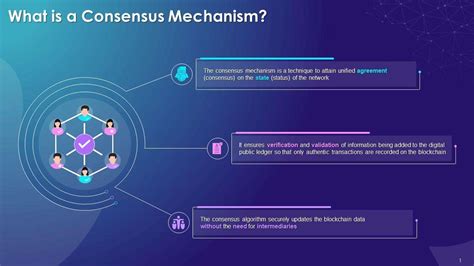

Consensus mechanism in cryptographic trade

The consensus mechanism is a Key aspectourrency exchange. It ensures that transactions are carried out effactic and safely, preventing malicous acts from manipulating the market. Consensus mechanisms can be divided into several types:

* Proof of things (POW) : s.

* Proof-Off-Stake (POS) : A more energy-saving alternative to Jena, in your validatores are amount on the cryptocurren puzzles.

Arbitration strategies

Arbitration is a trade strategy that applications of the price difference between two markts. In cryptographic trade, arbitration is associated with the thethhenification of the post. By using liquidity suppliers and efficient consensus mechanisms, traders can advantage of thee price differences to achives.

Sample arbitration strategy

Let’s assume, for example, that we want to replace Bitcoin (BTC) with two exchanges: Coinbase Pro and Binance. We identify the following price difference:

- In Coinbase Pro BTC trades for USD 40,000

- In binance btc trades for $42,500

There is a look of liquidity suppliers to some BTC at Coinbase Pro for $39,500 (current mark of the mark) and sell it at Binance for 42,500 USD. In this way, we will make the post arbitration:

Profit:

- Sales for USD 40,000 (Coinbase Pro)

- Buying for $39,500 (lucrateful margin trade)

- Sales for $42,500 (binance)

This profit of USD is 1,500 is a 3.8% return on investment.

Aplication*

To suum up, fluidity and consensus mechanisms are essentially essentially trading strategies. Using the benefits of decentralized exchanges, evidence of the mechanism of thene and efficient arbitration, traders can price differences to achieve succes on the cryptographic market. As the cryptocurrence of world, it is the crucial for traders to this point the latt achievements and the adapt.