Here is a comprehensive article on encryption, circulating offer, market signs and better wallets:

Title: Unlocking the secrets of encryption: understanding of the circulating offer, market signs and better wallets

Introduction:

Cryptocurrency has become an integral part of the global economy, with millions of people worldwide investing and negotiating digital assets. A crucial aspect of investment in encryption is to understand its underlying mechanics, such as the current supply, market signs and portfolios used by investors. In this article, we will delve into these -chave concepts and provide a comprehensive guide on how to navigate the cryptocurrency world.

Current supply:

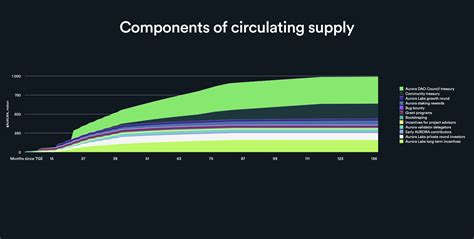

The circulating offer (CS) of a cryptocurrency refers to the total number of coins or tokens that are currently in circulation among all holders. It is calculated by adding the total number of coins coinned, as well as any additional currencies issued by strike, loans or other means.

For example, if Bitcoin’s current offer were 21 million and another currency called “Binance Coin” had a CS of 10 million, the total CS would be 31 million. This is important to understand why it affects market dynamics, as the total supply structure can affect price movements.

Market signs:

Market signs refer to various indicators that provide information on health and the general feeling of the encryption market. Some common market signs include:

- Price movement: The direction and speed of the price movement.

- Volatility: Price fluctuation, measured by standard deviations (eg, 20 -day interval).

- Market Cap:

The total value of all currencies in exchanges.

- Trading Volume: The number of negotiations performed within a certain period of time.

Understanding market signals can help investors make informed decisions and identify possible opportunities or risks.

Best wallets:

The choice of the right portfolio is essential to fill, manage and transmit cryptographic assets safely. Here are some better wallets for the consultant:

- Ledger Nano X:

A popular hardware -based wallet that sacrifices advanced security features.

- Metamask: A web -based wallet that allows users to interact with decentralized applications (Dapps) in Blockchain Ethereum.

- Cash Bitcoin Wallet: A simple and open source wallet designed specifically for Bitcoin cash transactions.

Other concepts -chave:

- Mining rewards: The amount of new currencies rewarded for miners who solve complex mathematical problems using their computing power.

- Strike rewards: The rewards obtained by validators (or “nodes”) in the Ethereum network through their ether tokens (eth).

- Dexs and Lammds: Decentralized Exchanges (Dexs) and Liquidity Sets that offer alternative investment opportunities.

Conclusion:

In conclusion, the understanding of the circulating supply, the market signs and the best wallets is crucial to sailing in the cryptocurrency world. Understanding these -chave concepts, investors can make informed decisions, avoid expensive errors and maximize their returns on investment. Whether you are an experienced encryption enthusiast or just starting out, it is essential to stay up to date with the latest developments in this exciting space.

Additional resources:

* COINMARKETCAP: A Cryptocurrency Market Data Platform Leader.

* CRYPTOSLATE: A popular news and cryptocurrency analysis site.

* Binance Blog: Binance official blog, presenting insights on various encryption topics.

I hope this comprehensive guide will help you unlock the secrets of encryption and make informed decisions about your investments. Happy investment!