Understanding the “Count” Column in the Ethereum Order Book on Bitfinex

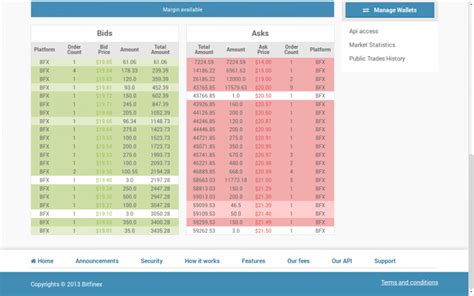

As a cryptocurrency trader, navigating the complex and ever-changing landscape of online exchanges like Bitfinex can be challenging. One often overlooked aspect of the order book is the “counts” column displayed on various digital exchange platforms. But what does this number actually mean for Ethereum traders?

In this article, we will delve into the meaning of the “Count” column in the Bitfinex Ethereum order book and examine how it works.

What is a count in the order book?

The count shows the number of orders placed at a specific price level during a specific period. In other words, it shows the total number of buy and sell orders that were executed at a specific price on the exchange during a specific period of time. The count can be used to gauge market sentiment, identify potential support and resistance levels, and analyze trading activity.

Ethereum Order Book on Bitfinex

On Bitfinex, Ethereum is traded on two main markets: ETH/USDT (US Dollar/Tether) and ETH/BUSD (Bitcoin/Ethereum). The order book for each market shows the number of buy and sell orders at different price levels over a given period of time. In this article, we will focus on the ETH/USDT market.

The “Count” Column

In the Bitfinex Ethereum order book, you can find several columns that provide valuable information about the market:

- Price: The current price level.

- Quantity: The number of buy and sell orders at the specified price.

- Quantity: The total volume (number of transactions) at the specified price.

- Calculation: This is what we are discussing here.

The “Calculation” column shows the total amount of all orders at different price levels over a given period of time. It is calculated by adding up the number of buy and sell orders for each price pair, including margin or leverage adjustments.

How to interpret the chart

To understand the importance of the calculation, let’s break down how it works:

- Price Range

: The “Count” column shows the total number of buy and sell orders at a given price level during the specified time period.

- Number of items: Each order represents a single transaction (buy or sell). Therefore, any order count in the “Count” column includes both buys and sells.

- Value added by new entries: When a new order is added to the exchange, it contributes to the total. This means that even if an order has already been canceled or executed several times, its value is reflected in the calculation.

Conclusion

The “Count” column of Bitfinex’s Ethereum order book provides valuable insights into market activity and trader sentiment. By understanding how this column works, traders can better understand the intricacies of online exchanges like Bitfinex.

To summarize:

- The number indicates the total number of buy and sell orders at specific price levels during the specified period.

- It is calculated by adding up the number of orders at different price levels.

- The “Number” column in the Bitfinex Ethereum order book is essential for traders to analyze market activity, identify support and resistance levels, and make informed trading decisions.

As with any complex topic related to cryptocurrency trading, it is always beneficial to consult with a variety of sources and seek professional advice if necessary. Happy trading!